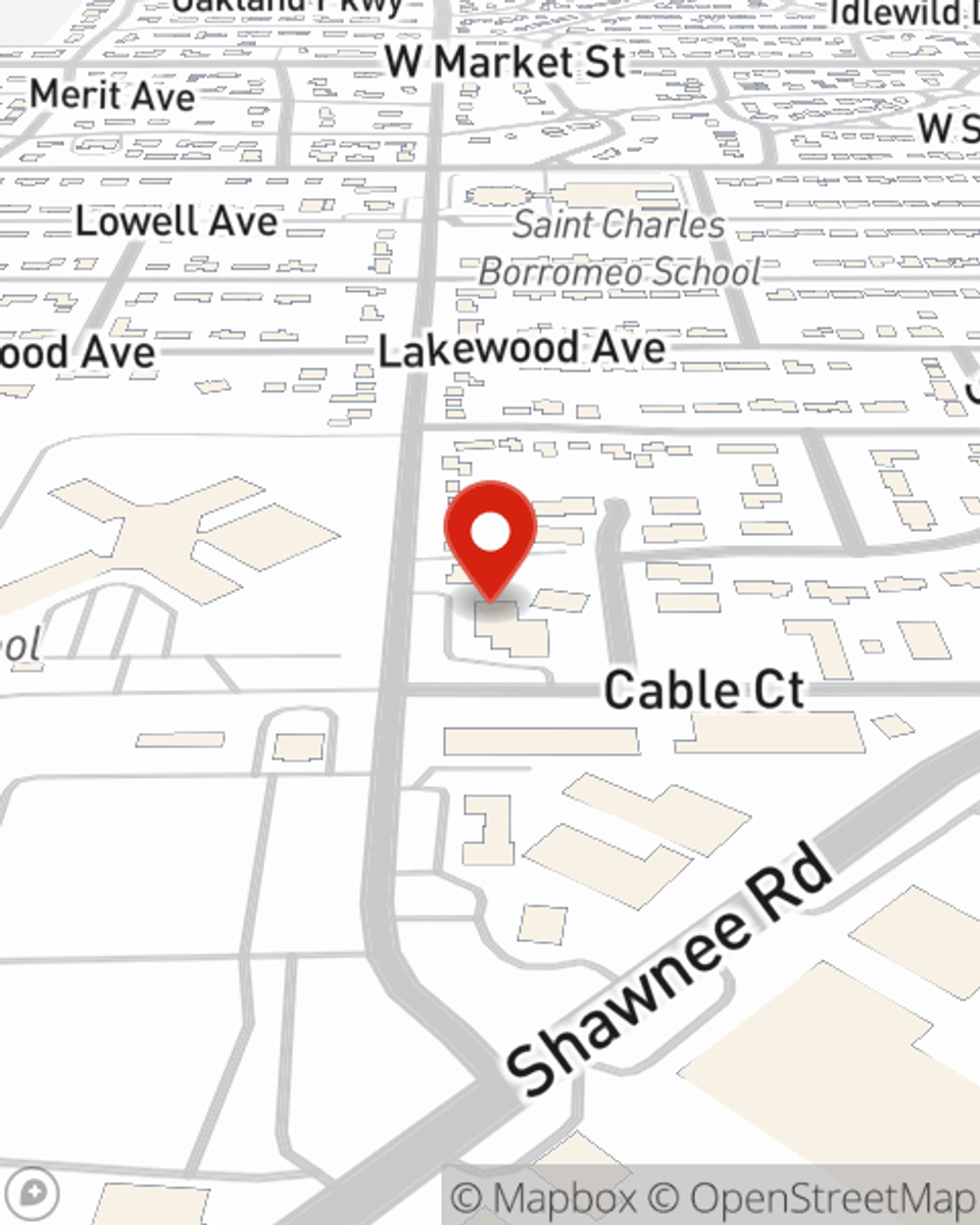

Business Insurance in and around Lima

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Spencerville, Ohio

- Detroit, MI

- Ann Arbor, MI

- Columbus, Ohio

- Wapakoneta, Ohio

- Bluffton, Ohio

- Ada, Ohio

- Marysville, Ohio

- Putnam County, Ohio

Your Search For Great Small Business Insurance Ends Now.

Operating your small business takes effort, commitment, and excellent insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, a surety or fidelity bond, and more!

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a dance school, a gift shop, or an ice cream shop, having the right insurance for you is important. As a business owner, as well, State Farm agent Shane Crites understands and is happy to offer personalized insurance options to fit the needs of you and your business.

Ready to talk through the business insurance options that may be right for you? Stop by agent Shane Crites's office to get started!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Shane Crites

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.